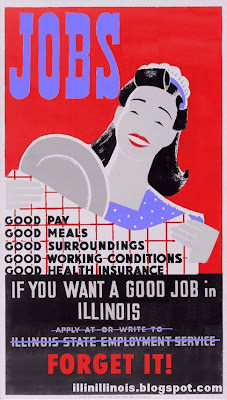

Uninsured Myths No. 2: "Everybody who works for a living is covered." FALSE.

Some conservatives would have you believe that people without health insurance are mainly indigent bums too ignorant to sign up for Medicaid. Not so. A recent study by Families USA showed that four out of five of the uninsured belong to working families.

Another study from the Robert Wood Johnson Foundation agrees, finding that nearly one in five U.S. workers is uninsured, a significant increase from fewer than one in seven during the mid-1990s, AP reports. "In Illinois, the study found that 16 percent of workers between ages 19 to 64 were uninsured in 2007, the latest year such figures are available. In 1995, 11.6 percent of workers in Illinois were uninsured."

Either their employers don't offer insurance or they can't afford the premiums. And private health insurance is ruinously expensive. According to the foundation, "Average costs for an individual insurance policy have increased 61 percent — from $2,560 in 1996 to $4,118 in 2006. Nationwide, the amount that employees pay for an individual policy has increased 79 percent." That's eight times more than wages have gone up during the same period.

If you can even get private insurance. I couldn't.

If you have any health problems, they won't take you. The video at right tells the story of Dr. Ajit Kesani, a Chicago doctor who can't get affordable health insurance because he has diabetes. Insurance companies may deny you coverage even for less serious conditions that you've recovered from, like a slipped disk or a case of tendinitis.

The state of Illinois sells the Illinois Comprehensive Health Insurance Plan, which is available to laid-off workers who've exhausted their COBRA benefits (which means you had to be able to afford COBRA, first) plus a limited number of people who've been turned down by private insurance. But it costs even more than private insurance. For example, the Chicago Tribune's Judith Graham reported, "In Chicago, a 35-year-old woman would pay $564 a month for a HIPAA plan with a $500 deductible, a 50-year-old woman would pay $871 a month and a 62-year-old man would pay $1,384." Multiply those numbers if you're covering a couple or a family. We couldn't keep up.

No comments:

Post a Comment

If you have trouble posting a comment, your browser privacy settings may be interfering. Change your settings to allow third-party cookies (session cookies will do) or add an exception for blogger.com. I apologize, but this is a Blogger issue over which I have no control.